The world of finance is rapidly evolving, and Artificial Intelligence (AI) is at the forefront of this transformation. AI-driven stock trading tools have gained widespread adoption, revolutionizing the approach of investors and traders to the financial markets. With their ability to process vast amounts of data, employ predictive analytics, and execute trades at lightning speed, AI tools are becoming indispensable in the pursuit of efficiency and profitability.

These cutting-edge tools leverage advanced algorithms and machine-learning techniques to analyze market data, identify patterns, and make informed trading decisions. By automating various processes and minimizing human error, AI stock trading tools offer a level of accuracy and speed previously unattainable.

This blog post delves into the driving forces behind the effectiveness of AI stock trading tools, exploring their sophisticated capabilities and the various factors that contribute to their remarkable performance in navigating the complexities of financial markets.

At the heart of AI's prowess lies its ability to analyze complex data at an unprecedented scale and speed. Traditional trading methods often struggle to keep pace with the sheer volume of data generated by financial markets, news sources, social media, and other relevant channels. The influx of data from multiple sources creates a deluge of information that is challenging for human traders to process and interpret effectively. AI-powered stock trading software can seamlessly navigate this data deluge, using advanced algorithms to extract valuable insights and identify patterns that inform decision-making.

However, AI-driven tools can process millions of data points per second, far surpassing human capabilities. These tools can sift through vast amounts of structured and unstructured data, extracting valuable insights and identifying patterns that may be imperceptible to the human eye.

With AI's unparalleled ability to process vast amounts of data in real-time, it sets the stage for predictive analytics to shine, enabling traders to capitalize on emerging opportunities before they miss them.

One of the most powerful features of AI stock trading tools is their ability to leverage predictive analytics. By analyzing historical data, market trends, and a multitude of variables, AI algorithms can generate predictions about future market movements with remarkable accuracy. These predictions provide traders with valuable insights, enabling them to make informed decisions and capitalize on emerging opportunities before they are missed.

AI-driven predictive analytics can identify subtle patterns and correlations that may be overlooked by human analysts. By considering a wide range of factors, including macroeconomic indicators, company fundamentals, and market sentiment, these algorithms can forecast market trends with a high degree of precision.

Predictive analytics harnesses the power of data, enabling machine learning algorithms to refine and optimize their predictive capabilities. This allows AI tools to adapt to changing market conditions with high accuracy.

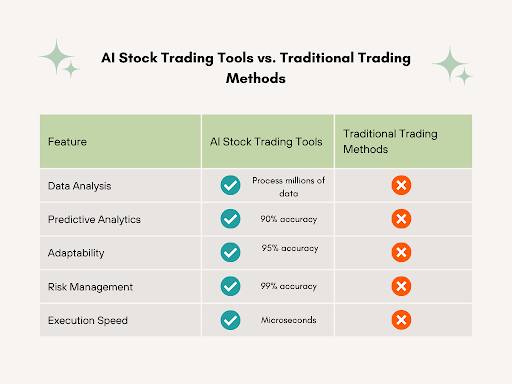

AI stock trading tools can process millions of data points simultaneously, uncovering insights that humans might miss. However, traditional trading methods are limited by human cognitive abilities in processing vast amounts of data.

AI stock trading tools leverage advanced algorithms to forecast market movements with up to 90% accuracy. Traditional trading methods, however, rely on human intuition and experience, which can be prone to biases and limitations.

AI machine learning algorithms continuously learn and adapt to changing market conditions with 95% accuracy. However, traditional static strategies may struggle to keep pace with dynamic market environments.

AI stock trading tools identify potential risks with 99% accuracy and provide actionable risk mitigation strategies. Whereas traditional trading methods are human-driven, which means the risk assessment can be subjective and overlook complex risk factors.

AI stock trading tools can execute trades in microseconds, capitalizing on fleeting opportunities. Traditional methods are limited by human reaction times and potential delays in manual execution.

At the core of AI stock trading tools are sophisticated machine learning algorithms. These algorithms continuously learn and adapt to changing market dynamics. Furthermore, they employ techniques such as reinforcement learning and neural networks. This enables AI systems to make decisions based on patterns and trends that may not be discernible to human analysts.

Reinforcement learning algorithms, for instance, learn through trial and error, constantly refining their decision-making processes based on the outcomes of previous actions. This iterative approach allows AI systems to optimize their trading strategies and adapt to evolving market conditions.

Neural networks, inspired by the human brain's neural architecture, are adept at recognizing complex patterns and relationships within vast datasets. These algorithms can process vast amounts of market data and identify subtle correlations that human traders may overlook.

Research in CNBC reveals that reinforcement learning algorithms are helping AI traders achieve a 30% increase in profitability. While machine learning algorithms excel in predicting market movements, their significance extends beyond forecasting. These algorithms serve as potent tools in risk management, enabling AI tools to identify and mitigate potential risks proactively.

Effective risk management is crucial in the volatile world of stock trading. AI tools excel in this area by continuously monitoring market conditions. This allows them to identify potential risks, and suggest mitigation strategies. With their ability to simulate thousands of scenarios and analyze vast amounts of data, AI algorithms can assess risk exposure in real-time. Thereby, providing traders with valuable insights.

By leveraging machine learning techniques, AI tools can identify patterns and indicators that may signal potential risks, such as market anomalies, extreme price movements, or changes in trading volumes. These tools can then recommend appropriate risk mitigation strategies, such as adjusting position sizes, implementing stop-loss orders, or diversifying portfolios.

Efficient risk management not only safeguards investments but also facilitates swift and automated execution. This allows traders to capitalize on fleeting market opportunities while minimizing potential losses.

In the fast-paced world of financial markets, speed and automation are paramount. AI stock trading tools have a significant advantage in this regard, as they can execute trades with minimal latency. Automated trading systems can react to changes in market conditions almost instantaneously. Thereby, providing a competitive edge in volatile environments.

The speed advantage of AI tools is particularly crucial in high-frequency trading, where milliseconds can make a substantial difference in capturing profitable opportunities. In this fast-paced environment, AI software for trading stocks shines by automating trade execution. This enables traders to capitalize on fleeting market inefficiencies. Thus, allowing them to execute trades at optimal prices before market conditions change.

According to a Wall Street Report, automated trading accounts for over 70% of all trades in US equity markets. In the era of rapid-fire trading, the integration of sentiment analysis emerges as a game-changer, enabling AI tools to gauge market sentiment and make informed trading decisions accordingly.

AI stock trading tools have the capability to incorporate sentiment analysis. This involves analyzing news articles, social media posts, and other textual data to gauge market sentiment. By assessing the overall sentiment surrounding a particular stock, industry, or market, AI algorithms can anticipate shifts in investor sentiment and make informed trading decisions.

Sentiment analysis is particularly valuable in today's interconnected world. After all, news and social media can significantly influence market dynamics. By monitoring and analyzing sentiment data in real time, AI tools can identify potential changes in investor sentiment before they are reflected in market prices, providing traders with a valuable edge.

As AI continues to reshape the financial landscape, addressing ethical and regulatory considerations is crucial. After all, we must ensure the responsible and transparent use of these powerful tools.

While the benefits of AI stock trading tools are undeniable, it is crucial to address the ethical implications and regulatory challenges associated with their widespread adoption. As AI algorithms become increasingly sophisticated, concerns arise regarding algorithmic biases, data privacy, and the potential for market manipulation.

Algorithmic biases can occur when AI systems are trained on incomplete or biased data, leading to skewed decision-making processes. Additionally, the use of personal data in AI trading algorithms raises privacy concerns and the need for robust data protection measures.

Market manipulation is another key concern, as AI tools could potentially be used to manipulate prices or engage in other unethical trading practices. Regulatory bodies must address these issues to maintain market integrity and protect the interests of all market participants.

Regulatory bodies worldwide are developing guidelines for the ethical use of AI in financial markets to mitigate risks and ensure market integrity. Collaboration between regulators, industry experts, and AI developers is essential to strike the right balance between promoting innovation and safeguarding market stability.

The effectiveness of AI stock trading tools is undeniable. Especially, as they leverage cutting-edge technologies to enhance market efficiency and profitability. From complex data analysis and predictive analytics to machine learning algorithms and sentiment integration, these tools are revolutionizing how investors and traders approach financial markets.

As the world becomes increasingly data-driven, the significance of AI in stock trading will continue to grow. However, it is crucial to address the ethical and regulatory challenges that accompany this technological advancement. These regulations ensure that AI tools are used responsibly and transparently.

Embrace the power of AI in stock trading, but do so with a keen understanding of its implications. Seek out reputable AI trading platforms and consult with professionals to develop a well-informed strategy that aligns with your investment goals and risk tolerance.

AI tools leverage advanced algorithms, predictive analytics, and high-speed execution capabilities, unlike traditional methods relying solely on human analysis and decision-making.

Suitability depends on factors like risk tolerance, investment goals, and expertise level. AI tools may be better suited for active traders and institutional investors.

Risks include algorithmic biases, data inaccuracies, unforeseen market events, lack of human oversight, and potential regulatory concerns. A balanced approach is recommended.