The Relationship Between Private Money Loans and Crowdfunding

Alternative lending options are gaining popularity, marking a shift in the financial landscape. Crowdfunding and private money loans are two relatively new alternatives to conventional banking that nonetheless interconnect. Although similar in that they both serve borrowers and investors looking for alternatives to traditional lending methods, the two are fundamentally different. Especially, in terms of structure, scope, and risk. In this article, we’ll investigate the connection between private money loans and crowdfunding. Further analyzing how these two financing mechanisms interact and mutually benefit one another in the modern financial landscape.

Private Money Loans

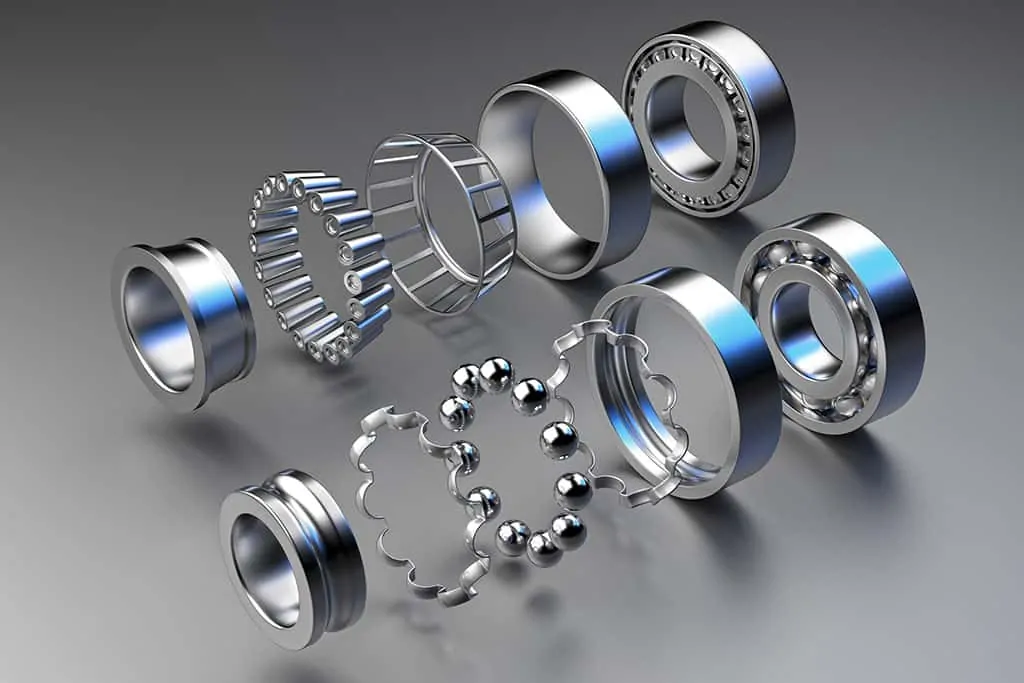

Borrowing from private individuals or businesses as opposed to traditional lending institutions like banks or credit unions is the basis of private money loans. They are also known as hard money loans. Borrowers with less-than-ideal credit histories or businesses that don’t fit the conventional bank loan mold are the target market for these types of loans. Furthermore, they typically use collateral from real estate. Private money lenders, also known as “hard money lenders” or “private lenders,” are a good option for real estate investors and developers. This is because they focus on the property’s potential rather than the borrower’s creditworthiness. Private Money Lenders Columbia, SC is more flexible and look into borrowers’ eye, never inconveniencing borrowers.

Advantages of Private Money Loans

Faster Processing

Private money loans are popular due to their speedy approval process. This gives borrowers rapid access to funds vital in time-sensitive real estate transactions.

Flexible Terms

Private lenders have more leeway in determining the terms of a loan. Thus, allowing them to provide borrowers with individual service that meets their specific requirements.

Asset-Based Lending

Private money loans are an example of asset-based lending. In this, the value of the collateral property is a priority over the borrower’s credit history.

Crowdfunding

Crowdfunding refers to a method of financing in which many people each contribute a small sum toward a common goal. Since the introduction of crowdfunding websites, which facilitate the introduction of project creators and potential backers, this idea has taken off. Crowdfunding is spreading beyond the realm of real estate and into the realms of technology, the arts, and charitable causes.

Types of Crowdfunding

Rewards-Based Crowdfunding

Crowdfunding in which donors receive a reward in some way other than monetarily is “rewards-based crowdfunding.”

Equity-Based Crowdfunding

In equity-based crowdfunding, backers receive a financial stake in the venture in exchange for their financial support.

Debt-Based Crowdfunding

Peer-to-peer lending, or debt-based crowdfunding, is a type of crowdfunding in which investors pool their money to lend to borrowers in exchange for interest payments.

Advantages of Crowdfunding

Access to Capital

Crowdfunding levels the playing field when it comes to gaining access to capital. Especially, as it allows startups and independent creators to raise money without approaching banks.

Market Validation

To attract more investors and customers, a successful crowdfunding campaign can act as proof that there is demand for the product or service offering.

Diversified Pool of Investors

Investors from all walks of life can contribute to a project through crowdfunding, Thus, expanding the circle of people who will invest in its success.

The Synergy between Private Money Loans and Crowdfunding

Despite their apparent differences, private money loans and crowdfunding can work together for mutual benefit.

Real Estate Crowdfunding

Investment opportunities in real estate are on many crowdfunding sites. Here, people pool money to finance building and renovation projects. Crowdfunding can also supplement the funds available from private money lenders in these situations.

Hybrid Financing

Private money loans and crowdfunding can be used together for certain real estate ventures. Initial expenses can be by private money loans. Then, you can raise the remainder of the budget through crowdfunding.

Access to Diverse Projects

Crowdfunding allows private money lenders to gain exposure to real estate projects outside of their immediate area. Thus, expanding the range of possible investments.

Conclusion

The dynamic between private money loans and crowdfunding shows how the landscape of alternative finance is always shifting. Both markets serve the needs of borrowers and investors who want to avoid using conventional banking services. Each has its own set of benefits and possibilities. Real estate investors can get access to capital quickly through private money loan companies such as Private Money Lenders Savannah, GA. Crowdfunding can fund a wide variety of projects and new businesses. The complementary nature of private money loans and crowdfunding is likely to grow in the years ahead. Thus, making for a flexible and easily accessible framework for capital formation and investment.