In today's fast-moving business scene, getting your financial reports right is absolutely crucial. It's not about making smart moves, pulling in more backers, or even just staying on the right side of the law. Instead, good, solid financial records are what keep a company steady and moving forward. But let's be real, aiming for that kind of accuracy takes a lot more than just wanting it. You've got to bring in the right tools and tactics to make it happen.

In this post, we're exploring six proven techniques that companies can use to boost the sharpness and speed of their financial reporting process. From tapping into the latest tech to building a team that's focused on improvement, these tips are key for anyone looking to tackle the financial challenges of our time and keep succeeding in the long run.

Central to a strong financial reporting framework is account reconciliation. This method entails the review of financial statements to confirm their consistency. Through consistent account balancing, companies can spot differences, pinpoint mistakes, and avoid incorrect financial declarations.

Furthermore, the introduction of sophisticated accounting programs is transforming this method. It provides tools for automated balancing that simplify the process and reduce the chance of mistakes made by humans. With this automation, financial departments can conserve essential time and effort while upholding utmost precision.

In today's interconnected economy, businesses frequently conduct transactions involving various currencies. Effectively handling these transactions demands close monitoring of exchange rates and currency conversions.

In this context, incorporating a currency conversion API is extremely beneficial. By leveraging these APIs, organizations can instantly access up-to-date exchange rate information. Furthermore, they can streamline the conversion procedure. This not only guarantees precision in financial records but also simplifies international transactions. Thereby, allowing businesses to function more effectively on a worldwide level.

In today's landscape, where cybersecurity threats are a constant concern, it's important for companies to understand that the main cybersecurity threat often comes from within. Often it's due to human error, which is responsible for more than 80% of incidents.

Effective internal controls act as a defense against fraud, mistakes, and financial mishandling. They lay a stable groundwork for trust and reliability within the organization. By implementing robust control measures, companies can show their dedication to following rules and ethical behavior. Thereby, further fostering an environment of honesty within the firm.

Methods like dividing responsibilities, regular checks, and strict permission procedures help reduce risks and inspire trust in the accuracy of financial reports. In turn, this boosts confidence among stakeholders and strengthens the company's standing. By giving priority to internal controls, businesses can maintain transparency and responsibility in their operations while also improving efficiency and resource management.

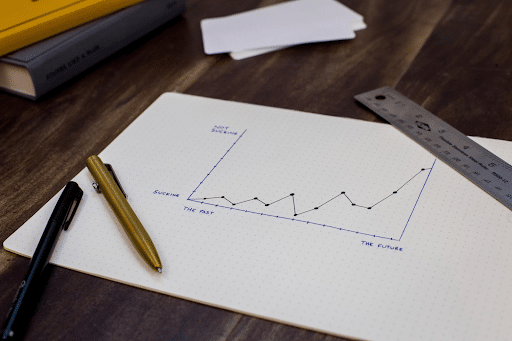

Financial prediction and budget management are crucial drivers of strategic choices and effective financial resource management. This allows firms to remain flexible in a rapidly changing market. Utilizing specialized software tools for financial prediction and budgeting, organizations can extract valuable insights into future financial performance. Thereby, empowering them to predict market trends and seize emerging opportunities.

These tools facilitate the creation of precise projections and identification of potential risks. Moreover, they allow efficient allocation of resources, which promotes resilience and adaptability in uncertain circumstances. With improved visibility and planning capabilities, organizations can adjust to shifting market conditions. Thus, optimizing their financial strategies for enduring success, positioning themselves for sustained growth and competitiveness.

The introduction of automation has significantly changed how companies manage daily financial duties. This is changing old methods and boosting how things work overall. From dealing with invoices to keeping track of expenses, automation tools bring a new level of efficiency and precision. Thereby, freeing up time and assets for more important projects.

By handing over repetitive tasks to automation, finance departments can dedicate more energy to critical tasks, like analysis and supporting decisions. In turn, this fosters innovation and leads to better results throughout the company. Moreover, by adopting automation, firms can refine their procedures and enhance the quality of their financial reports. This makes them more nimble and competitive in an ever-changing business landscape.

It's crucial to keep financial teams up-to-date through regular development programs. Ensure they stay on top of changing industry standards and methodologies. After all, constant education allows these professionals to enhance their skills, stay in line with new rules, and make the most of emerging technologies.

Participating in workshops, seminars, and online learning sessions opens doors to improving abilities and exchanging insights. Supplying financial teams with the latest tools and insights helps cultivate an environment focused on excellence and ongoing enhancement of financial reporting techniques.

Beyond the usual educational paths, companies can also support mentorship arrangements and group learning projects to encourage sharing knowledge among colleagues. Additionally, introducing game-based learning can turn education into a fun and memorable experience. This solidifies the understanding of key financial concepts.

By prioritizing a learning-centric workforce, companies not only boost the proficiency of their financial staff but also gear up for enduring achievement in an ever-changing financial environment.

Precise financial documentation isn't just a box to tick for regulators; it's a cornerstone of thriving organizations. From automated reconciliation systems to sturdy internal checks, every tactic plays a part in constructing a robust financial management structure. By championing accuracy and embracing new ideas, companies can confidently steer through the intricacies of modern business landscapes.